Table of Contents

Since the passage last week of President Trump’s domestic agenda, the Department of Education now has less than a year to carry out what policy analysts are calling the most significant overhaul to federal student aid in more than a decade, raising questions about whether the agency can pull it off.

Ensuring a smooth transition in such a short time frame would have been a heavy lift for any education secretary, but higher education experts say it will be nearly impossible for Linda McMahon, as she cut the department’s staff by nearly 50 percent earlier this year.

“I worry that that implementation is a really big ask for the department in the way that it is staffed,” said Beth Akers, a senior fellow at the conservative think tank the American Enterprise Institute who focuses on the economics of higher education. “The responsible thing to do would be to put in legislation about staffing at the department or to move [certain programs] to other agencies.”

Under the One Big Beautiful Bill Act, the department will have to eliminate an entire loan program for graduate students, consolidate repayment options for future borrowers, increase the endowment tax and introduce a whole new accountability metric based on students’ earnings. On top of that, public colleges will be forced to bear the burden of budget cuts, as the bill includes a slash of more than $1 trillion in funding for Medicaid and the Supplemental Nutrition Assistance Program, which are expected to leave gaping holes in state budgets across the country.

Jon Fansmith, senior vice president for government relations at the American Council on Education, said the agency and colleges are taking on a “Herculean task.”

Ellen Keast, deputy press secretary of the department, called the new law a “historic win” and said officials will provide periodic updates about implementation.

Combined, policy analysts say that the higher ed provisions in the bill might be the closest Congress will get to reauthorizing the Higher Education Act, which hasn’t had a comprehensive update since 2008. But the bill’s text often skims over the details, leaving colleges with lots of questions and Federal Student Aid officials with little time to answer them.

Karen McCarthy, vice president of public policy at the National Association of Student Financial Aid Administrators, pointed to the botched rollout of the new Free Application for Federal Student Aid in 2024 as a prime example of how difficult implementing new legislation can be. (Congress passed the FAFSA Simplification Act in December 2020, and the new application for student aid wasn’t launched until three years later.)

“We are hoping that the Department of Ed, broadly, can apply some of the lessons that they learned,” she said. “Colleges need clear guidance from the department and enough time to do implementation work on their end.”

Meanwhile, Trump has remained dedicated to fulfilling his campaign promise to close the Department of Education. So how the department can implement these provisions remains unknown.

Seeing the new higher ed provisions “run smoothly may be a little too much to hope for,” Fansmith said. “Hopefully they don’t implode. That’s our guiding principle right now.”

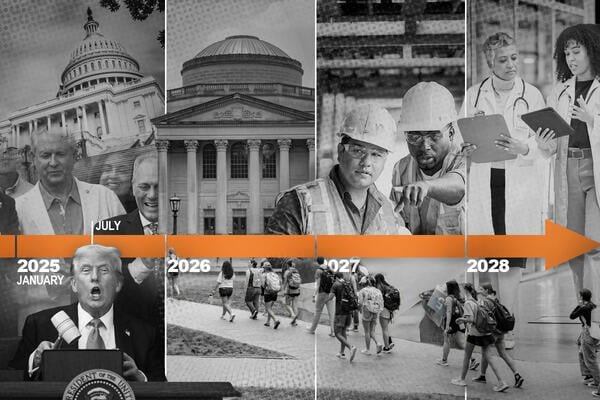

From grappling with budgets to working with students and awaiting policies, colleges and universities as well as the Education Department face a long to-do list as they prepare for the One Big Beautiful Bill Act to take effect. Here’s what some experts are watching for.

Finding the Money

Although the trillion-dollar slash to the social safety net will be one of the last elements to take effect in 2028, policy analysts predict that public colleges and universities will feel the repercussions before then.

That’s because states will need to quickly figure out how they plan to make up for the loss in federal funding. Much of the $1 trillion in Medicaid savings will come from cuts to state subsidies, leaving state leaders with multimillion-dollar budget gaps. For example, Maine governor Janet Mills told NPR she expects her state to lose $4.5 billion over the next decade.

If states have to cut their budgets, higher education is often the first line item to be sacrificed since colleges can generate their own revenue in a way others, like K–12 education, cannot.

“[States] are probably already running the numbers to see what the actual impact is going to be,” said Bryce McKibben, senior director of policy and advocacy at the Hope Center for Student Basic Needs. “So higher education could start to feel the squeeze” and “it’s going to have a very significant downstream impact on students and families.”

And the bill might not be the only hit coming for state budgets. Congress is about to begin a tense budget negotiation process, and fiscally conservative Republicans could push for even steeper funding cuts.

In the past, funding cuts for higher ed have led to rising tuition prices and decreases in state grants and institutional scholarships. Colleges could also be forced to cut staff and freeze spending on wraparound student support services like food pantries, transportation and childcare.

“We really worry about this because many colleges have erroneously viewed their basic needs work as extra credit … and nothing could be further from the truth,” McKibben said. “If institutions end up cutting those types of services, then you’ll just see more students dropping out, which only further harms the budget.”

Some of the wealthiest private colleges will also have to reconsider their budgets as they brace for the endowment tax to rise to up to 8 percent. The current rate is 1.4 percent, and experts have warned that the increased tax could hurt financial aid budgets. The higher tax bill will be due April 2027.

Advising Students

As state lawmakers deal with their budgets, college financial aid offices will be looking for updates from the Department of Education and trying to advise students on how best to pay for college.

The caps on Parent PLUS and graduate loans won’t take effect until next summer, and students with existing loans won’t be affected. But details on the path forward for current borrowers as well as which academic programs will be held to which caps are still unclear.

“Schools and borrowers need to know exactly what’s down the line and what their loan eligibility will be by July 2026,” McCarthy from NASFAA said.

Colleges may also have to explore partnerships with private loan companies in order for graduate students to enroll and will need to understand the new income-driven repayment options in order to help borrowers select the right plan after they graduate.

Much of that information will come from the department’s policies, McCarthy added, but it remains unclear which provisions will be clarified through informal guidance and which will require a formal rule-making process. Those that do have to go through the formal process will take longer to finalize.

“Acting Under Secretary James Bergeron spoke to a virtual conference yesterday and alluded to conversations that they’re having about potential [negotiated rule-making] sessions. He didn’t say anything definitively, but he did say they’ll be making some announcements,” she said. “So that’s definitely a big wild card in terms of the timeline for implementation.”

Gathering Data

What colleges can do while they wait, Akers from AEI said, is start “triaging” by collecting and analyzing data on how these policy changes will impact potential revenues.

For graduate programs, that means assessing whether the cost of tuition exceeds borrowing thresholds. If it does, colleges may need to lower tuition, prepare for fewer students to enroll or cut the program altogether, she said. On the undergraduate side, colleges need to prepare for the new accountability measures and check whether their average graduates make more than adults with a high school diploma. All those changes take effect July 1, 2026.

“Those are the places they’re going to need to make the big changes pretty quickly, because you can’t be enrolling students for next year in these programs if it’s unclear whether the students themselves can pay for it,” Akers explained.

The government may have to do its own data collection as well, as it remains unclear whether the existing College Scorecard is enough to run the new earnings test. The department also has been collecting program-level data from colleges as part of the new financial value transparency framework, which should provide some of the necessary information. Colleges have until Sept. 30 to report the data, though that deadline has been pushed back several times.

If the department lacks what it needs, colleges might have to put in more legwork. But all in all, Fansmith from ACE said, collecting the data and running the analyses will be worth it and may even help in lobbying for amendments to the parts of the bill that colleges find most concerning.

“This is not the time to step back. If we are going to get fixes, [Congress] need to know where the problems are,” he said. “Reconciliation is over, but we’re going to be living with this for a while. The question is, how do we make sure that it is functionally doing the least possible harm and the most possible good?”